The views expressed in the article are those of the author and do not necessarily represent the views of the European Commission.

The European Public Sector Accounting Standards (EPSAS) project aims to increase the transparency and comparability of public sector financial accounting and reporting between and within EU Member States by developing and implementing a harmonised European accounting framework. Information on income and expenses, and assets and liabilities is important for accountability and informed decision-making. In contrast to the private sector, no common accounting standards for financial reporting are in place for the public sector in the EU.

The Commission services have been following a two-phase approach to EPSAS. In Phase 1 the focus has been on increasing fiscal transparency in the Member States in the short to medium term by promoting accruals accounting and, in parallel, developing the EPSAS framework (covering governance, accounting principles and standards).

During Phase 1 of the EPSAS project, support has focused on the voluntary modernisation of public accounting systems on accruals bases. There has been an increased willingness of many Member States to implement or improve accrual accounting in their public sector, and significant progress was also made on the necessary technical preparations for taking forward the project. There is a growing acknowledgement of the benefits of accrual accounting for government entities in the Member States, and of transparent and comparable financial accounting and reporting practices.

Eurostat commissioned an updated report for Member States on accounting maturity and reform costs relating to the modernisation of public accounting systems/EPSAS. An increase in the accounting maturity score was recorded in 2018 compared to 2013, indicating that many governments are indeed on the path to significant public accounting reforms. In this period the (unweighted) estimated average accounting maturities increased across all sub-sectors of government:

- Central governments from 51% to 65%.

- State governments from 43% to 54%.

- Local governments from 65% to 73%.

- Social security funds from 54% to 57%.

These average accounting maturity scores are expected to increase further, for all sub-sectors of government, between 2018 and 2025.

The EPSAS development work is presented and discussed at the Commission Expert Group on EPSAS. The November 2021 virtual meeting covered IPSAS ‘screening reports’. On behalf of Eurostat the contractors assessed each individual IPSAS against the principles set out in the draft EPSAS conceptual framework. In the same meeting Spain, Greece and Italy also presented the state of play of their public accounting systems.

In the last virtual meeting in May 2022, a Eurostat paper on the structure of national public accounting frameworks was presented. The paper summarized information collected from 8 Member States. Lively discussions in the Expert Group facilitated the sharing of information and good practices among Member States. Another topic on the agenda was innovative tools and solutions for public accounting. A contractor presented a discussion paper on behalf of Eurostat, and a real life example for an innovative solution was provided by Lithuania. Also in the same meeting Croatia, Ireland and Luxembourg presented updates of their accounting reform to the Expert Group. The Commission Expert Group on EPSAS is the only European platform for discussing public sector accounting related challenges and technical issues across countries, in order to learn from each other’s experience and expertise.

The Expert Group meeting was informed that the project had lost some momentum due to other political priorities such as the responses first to COVID-19 and then Russia’s invasion of Ukraine. Whilst it was very unlikely that there would be any Commission proposal on EPSAS put forward under the current Commission, work would continue under the current mandate for EPSAS, that is, under Phase 1 of the two phase approach, and less resources would be devoted to the task. The options for EPSAS moving forward in future remained the same, from fully voluntary to partly or fully mandatory.

It was announced that the Spanish Ministry of Finance will host the next physical meeting in November 2022. Concerning the issues to be taken up next by the Expert Group, it was proposed to carry out further work on the perimeter of EPSAS, on standards and the link to the Conceptual Framework, and also to develop the Expert Group as a forum for sharing Member States’ experiences on public sector accounting issues.

The Eurostat EPSAS website provides comprehensive information on the work that has been undertaken in recent years, including for example, access to all technical documents, analyses carried out and working documents from the EPSAS Expert Group (https://ec.europa.eu/eurostat/web/epsas).

Note by KDZ

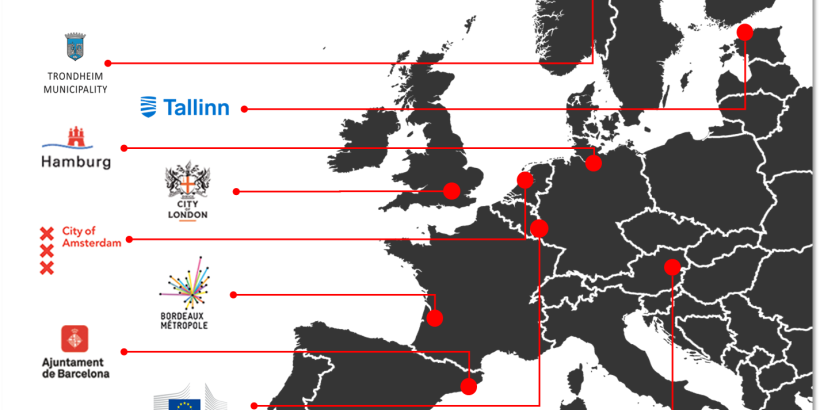

EPSAS is one of the topics regularly debated in the Cities for Sustainable Public Finances (CSPF) network. As a European reference group in local public financial management, it counts on the active participation of the European Commission – Eurostat. Find more information on www.cspf.eu.

Further references:

European Commission – Eurostat – EPSAS