1. Introduction

This article provides a country comparison on local finances and local autonomy. The analysis of different data sources provides an overview of European local governments finances and their financial self-reliance. Furthermore, countries are compared regarding their degree in fiscal autonomy and decentralization. In scientific literature local autonomy is measured using different indicators, most commonly quantitative indicators like shares of financial resources, e.g. subnational expenditures and revenues as shares of general government budgets. However, to give a comprehensive picture on local autonomy qualitative indicators like the share of responsibilities allocated to subnational governments are considered as well. The quantitative indicators used in this article are local governments per capita expenditures, subnational expenditures as a share of general expenditures, the share of intergovernmental transfers and the share of tax revenues. Local tax autonomy and the local autonomy index (LAI) incorporate quantitative and qualitative measures. Both indicators supplement the comparison. The article concludes by linking the LAI with the government effectiveness indicator.

Why it is important: Scholars find that the relationship between local autonomy and well-being, satisfaction with services, democracy and trust are positively correlated (Bjornskov et al., 2008; Ladner et al., 2021). In general, it is argued that fiscal decentralization can lead to improvements in social outcomes (e.g. health and education). The necessary prerequisite, highlighted by Nakatani et al. (2022), is good governance.

2. Local Government Budgets in Europe

Figure 1 shows a diverse picture of local governments per capita expenditures in 2020. The average per capita local expenditures in Europe was 3.492 Euro. Denmark, with per capita expenditures of 18.470 Euro, shows the highest local government expenditure per inhabitant, followed by the other Nordic countries (Sweden, Finland and Norway) and the Netherlands, which are significantly above the European average. On the contrary, traditionally centralized countries in Eastern Europe, such as Hungary with 904 Euro expenditures per capita, are far below the average. The federal countries Belgium, Germany, Austria, Spain and Switzerland report a second layer of subnational expenditures, i.e. state expenditures, which are not included and therefore an explanation for the lower figures in these countries.

3. Decentralization in Europe

According to a study from the Council of European Municipalities and Regions (CEMR, 2022) big differences in decentralization occur in European countries. In figure 2 the share of subnational government expenditure of general government expenditure is visualized and provides a measure on the degree of decentralization in the 40 member countries of the CEMR.

The data reveal that while the average share of subnational government expenditure in 2020 is 23.95%, the differences between the countries are high. 18 out of 40 CEMR countries are rather centralized with values below 20%. Within this category Malta, Cyprus and Greece are highly centralized with shares of subnational government expenditure of 1.1%, 3.6% and 6.5%, respectively. The remaining CEMR members show medium to high decentralization. The countries with the highest shares of subnational expenditures are Denmark, Belgium (federal), Germany (federal), Sweden, Spain (federal) and Finland with 64.4%, 49%, 48.9%, 48.7%, 47.3% and 40.1%. Within this category, all federal countries except for Austria (33,1%) show high degrees of decentralization since subnational expenditures include the state level.

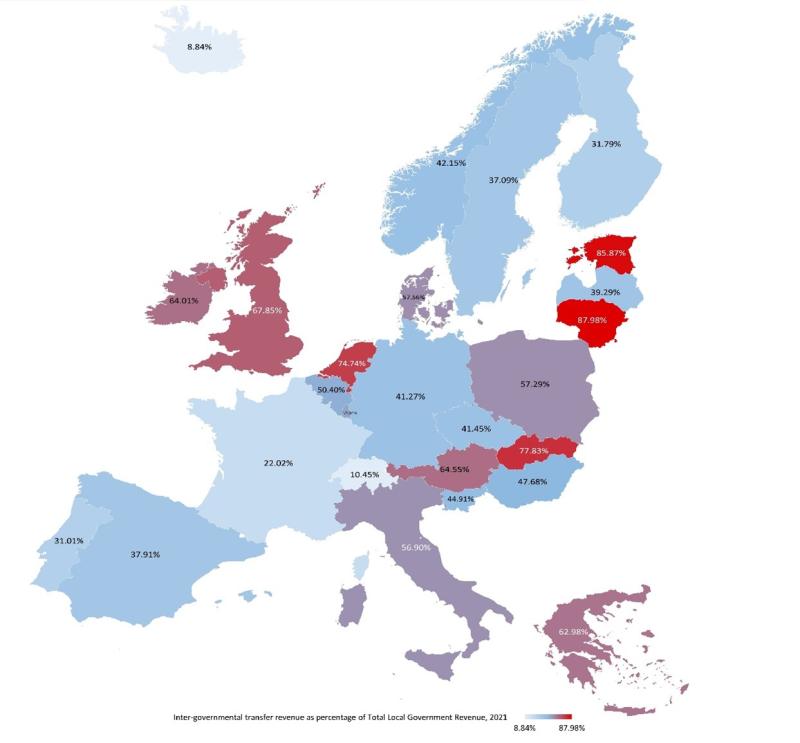

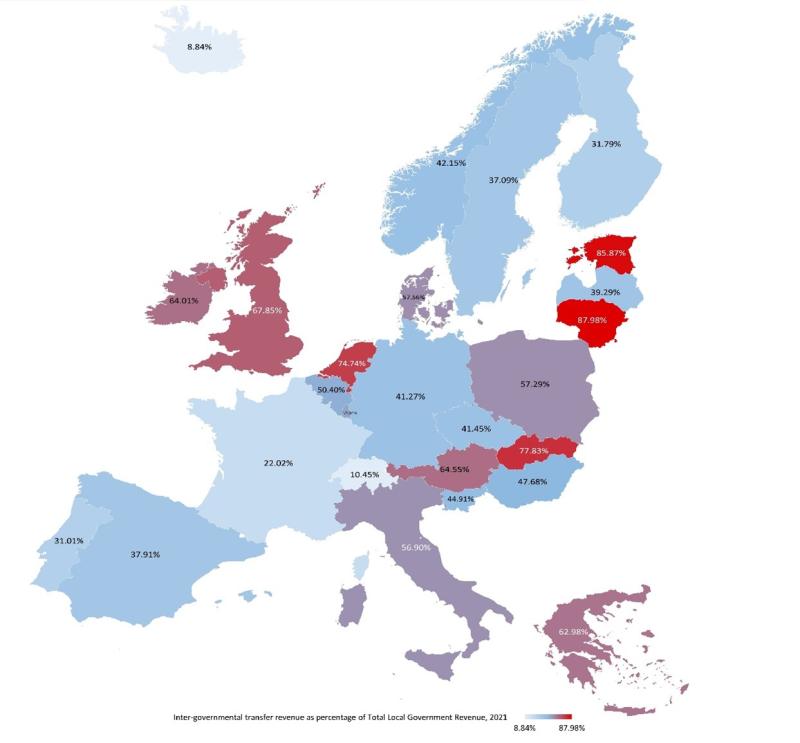

4. Local Government Dependency on Intergovernmental Transfers

Figure 3 shows the share of local budgets resulting from intergovernmental transfers. It is assumed that the higher the intergovernmental transfers, the greater is the financial dependence of local governments on other tiers of government and the lower is the local autonomy.

The average for the OECD-European countries is 49.8%, which shows a strong dependence of local governments on intergovernmental transfers: in 13 out of 26 countries, transfers from other levels of government represent the largest share of the local budget, accounting for 50% or more of local revenues. Lithuania, Estonia, the Slovak Republic and the Netherlands are the countries with the highest share of intergovernmental transfers with 87.9%, 85.8%, 77.8% and 74.7%, respectively. Among the other 13 countries, Iceland and Switzerland have the lowest share: intergovernmental transfers account for 8.8% (Iceland) and 10.5% (Switzerland) of local revenues. It is important to stress that intergovernmental transfers can also include shared taxes and, in some countries (e.g. Italy), regional budgets too.

5. Local Governments own tax revenues in Europe

Business and property taxes represent the most common taxes levied by municipalities in Europe. Own local taxes, jointly with own fees, are an important source of revenue for local governments to balance municipal budgets and to guarantee local autonomy. Data from the OECD Fiscal Decentralisation Database show the percentage of the local budgets which comes from own tax revenues: it is assumed that the higher the share of tax revenues, the less the financial dependence of local governments on transfers from the central government.

Figure 4 shows that in Europe the average share of own tax revenues of total local revenues is 32.1%: in 8 out of 26 countries, tax revenues represent only a small share of the local budgets, accounting for less than 20% of local revenues. Estonia, the Czech Republic, Lithuania, the Slovak Republic, the Netherlands, Ireland and Austria are the countries with the lower share of less than 15% tax revenues at local level.

Among the other 18 countries, Iceland, Sweden, Switzerland and Spain have the highest share (above 55%): tax revenues account for 78.8% (Iceland), 60.2 (Sweden), 58.8% (Switzerland) and 58.2% (Spain) of local revenues.

6. Local Tax Autonomy

On the one hand local tax autonomy is defined as the ratio of tax revenue in the local budget. On the other hand, as highlighted in the CEMR report, the local government’s competence to determine local taxes, set tax rates and tax reliefs are important characteristics of good multilevel governance and local tax autonomy as well. In figure 5 the local tax autonomy indicator is based on data of the OECD Fiscal Decentralisation database, it includes quantitative and qualitative characteristics and was further modified for the purposes of the CEMR-report. The average local tax autonomy for the CEMR countries is 73%. 16 out of 28 countries are above 90%. In these countries local governments have high tax autonomy: they are authorized to set tax rates and reliefs for municipal taxes. Four European countries (Austria, Latvia, Poland and Slovenia) have a multi-level governance system characterized by weak local tax autonomy with a share of 23.7%, 13.6%, 25.6% and 15.7%, respectively. In 6 countries the value is below 30%, they have minor or no competence on setting rates and reliefs.

7. Local Autonomy Index (LAI)

The report “Self-rule index for local authorities in the EU, Council of Europe and OECD countries, 1990-2020” (Ladner et al., 2021) presents an analysis of local autonomy in 57 countries across 30 years. Local autonomy is described by eleven variables, these are combined to seven dimensions (i.e. legal autonomy, policy scope, political discretion, financial autonomy, organizational autonomy and non-interference) which in turn are condensed to the local autonomy index (LAI). The LAI provides an appropriate estimator for local autonomy as non-quantitative characteristics and competences are measured.

According to the authors, and similar to the above findings, Nordic countries in Europe are high performers. Switzerland, France and Liechtenstein show a high degree of autonomy (index values above 70) as well. Countries with a low index (less than 40) are Cyprus, Malta and Moldova. In between these two groups there are countries where municipalities have a medium-high degree of autonomy (index values between 60 and 70): Norway, Portugal, Spain, Germany, Slovakia, Serbia, Estonia, Italy, Lithuania, Poland, Austria, Belgium and Greece. Countries with a medium degree of local autonomy (values between 50 and 60) are: Netherlands, Bulgaria, Luxembourg, Montenegro, Czech Republic, Georgia, Macedonia, Albania, Slovenia, Latvia, Bosnia and Herzegovina, Romania and Croatia. Countries with a medium-low degree of autonomy (values between 40 and 50) are thus: United Kingdom, Ukraine, Kosovo, Hungary, Turkey and Ireland. Countries with a federal governance system are in the upper or upper middle range of local autonomy.

8. Conclusions

Local governments are the bodies closest to the citizens. Thus, decentralisation and local autonomy are the keys to good governance and better services. Data show that at European level, several of the countries are rather centralised and local governments do not have much autonomy. In terms of fiscal autonomy, it can be seen that a high percentage of local budgets comes from intergovernmental transfers, which means that most local governments are fiscally dependent on the central level: the average for the OECD European Countries is 49.84% (figure 3). Own local taxes and fees for services are important revenues to ensure balanced municipal budgets and local autonomy. However, even though on a European level the average of local budgets coming from own tax revenues is 32% (figure 4).

Figure 7 relates the LAI, which ranges from 0 to 100, with the World Bank’s government effectiveness indicator (WGI, 2020), which ranges from -2.5 (weak) to 2.5 (strong). Government effectiveness is measured through perceptions on the quality of public services, the quality of civil service and its independence from political pressures, the quality of policy formulation and implementation and the credibility of the government’s commitment to these policies. The correlation plot shows that higher local autonomy is associated with higher government effectiveness. At the top right, 13 out of 35 countries have medium to high local autonomy scores (above 55) and at the same time high government effectiveness scores (above 1). Whereas countries with weaker local autonomy underperform regarding government effectiveness too.

In some cases a high value of local autonomy (above 55) and low government effectiveness (below 1) can be observed at the same time (yellow rectangle). The reasons need more clarification. It can be observed that most of these countries run through institutional transition or were hit particularly hard by financial crises. This suggests that local autonomy does not automatically lead to better government effectiveness. But in general, it can be stated that there is a connection between strong local autonomy and high government effectiveness.

Since there is a positive relationship between local autonomy and effective governance, it is imperative for countries to increase local governments fiscal independence. In order to ensure local autonomy and more balanced municipal budgets, greater shares of fees and own local taxes are needed to avoid the fiscal dependence of local governments on other tiers of government. Especially in Eastern European countries reforms towards more local tax autonomy are needed.

Sources

Bjørnskov, C., Drehe, A., Fischer, J.A.V., 2008, “On decentralization and life satisfaction”, Economics Letters, Volume 99, Issue 1, Pages 147-151, https://doi.org/10.1016/j.econlet.2007.06.016

CEMR, 2022, “Local Finances and the Green Transition”, Council of European Municipalities and Regions (CEMR), https://localfinances-cemr.eu/

Eurostat database, https://ec.europa.eu/eurostat/data/database

Ladner, A., Keuffer, N., Bastianen, A., 2021, Self-rule index for local authorities in the EU, Council of Europe and OECD countries, 1990-2020” European Commission, Directorate-General for Regional and Urban Policy, Brussels

Ladner, A., http://local-autonomy.andreasladner.ch/

Nakatani, R., Zhang, Q.,Garcia Valdes, I., 2022, “Fiscal Decentralization Improves Social Outcomes When Countries Have Good Governance” International Monetary Fund (IMF) Working Papers 22/111, Washington D.C.

OECD Fiscal Decentralization Database, https://www.oecd.org/tax/federalism/fiscal-decentralisation-database/

World Bank WGI, https://info.worldbank.org/governance/wgi/