OECD-SIGMA Programme and European Commission have published the 2023 edition of the Principles of Public Administration with a focus on digitalization, environmental sustainability and multi-level governance.

„The Principles are a comprehensive framework of standards expressing values and behaviours that citizens and businesses can expect from a modern public administration. ….They build on existing EU acquis, OECD recommendations, other international standards, as well as good practices of the EU and OECD countries.“ (page 6) The first edition has been published 2014.

The new standards for multi-level governance defined for the first time in Europe are of particularly importance. These are set out in Principles 14 (Subsidiarity) and 32 (Fiscal Autonomy). They cover areas like division of competences, autonomy to perform the competences, co-ordination structures, distribtution of finances, local borrowing, financial equalization mechanism, own taxes and fees, etc.

Further new areas like „transparency“ have also great potential for further developing good governance in Europe.

The European Commission has pointed in the Communication „Enhancing the European Administrative Space (ComPAct) https://commission.europa.eu/system/files/2023-10/Communication_Enhanci…) that the principles will also be important for the member states in the future. Currently the main adressees are candidate countries.

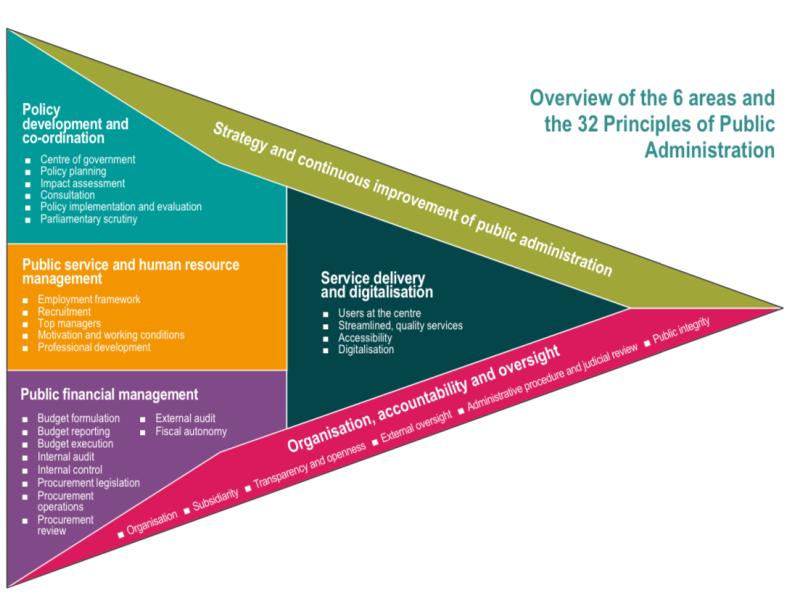

The principles continue to consist of six subject areas and 32 principles that describe the values, behavior and effects of good public administration.

1️⃣ Strategy

2️⃣ Policy development and coordination

3️⃣ Public service and human resource management

4️⃣ Organization, accountability and oversight

5️⃣ Service delivery and digitalization

6️⃣ Public financial management

Attached are the Principles 14 (Subsidiarity) and 32 (Fiscal Autonomy) for Mulitlevel Governance

Principle 14: Responsibilities are clearly distributed between levels of government, embracing the principle of subsidiarity and local autonomy, and facilitating inter-institutional co-ordination with effective oversight mechanisms.

a. The parliament establishes by law the division of competences, rights and duties across levels of government to avoid overlap and strengthen transparency.

b. Regional and local governments have autonomy to perform their competences within the limits of applicable laws.

c. The competent authorities exercise supervision over regional and local governments based on law. This supervision is proportional and respects their autonomy in decision-making, distinguishing between own and delegated competencies and providing for remedy in case of breach.

d. An independent mechanism resolves conflicts of competencies and responsibilities among levels of government.

e. Effective co-ordination structures facilitate alignment of policies and priorities at all levels of government.

f. Regional and local governments co-operate and form partnerships to enhance the development and the quality of public services.

g. Competencies are assigned to the level of government closest to citizens, taking into account the extent and nature of the task, efficiency and economy, as well as the size of regional and local governments.

Principle 32: Regional and local governments have resources and adequate fiscal autonomy for exercising their competences, with financial oversight to foster responsible financial management.

a. The distribution of finances across levels of government is established by law, guaranteeing diversified revenues and borrowing rights while mitigating the fiscal risk of developing an unsustainable debt burden.

b. A transparent and predictable fiscal equalisation mechanism balances the resources among regional and local governments.

c. Financial oversight, by public authorities or external auditors, is performed to consider the financial situation of regional and local governments, supports the effective use of finances and helps prevent financial imbalances.

d. Regional and local governments partly derive their financial resources from local taxes, fees and charges, for which they have the power to determine the rate.

e. Earmarked allocations to regional and local governments have functional classification and are restricted to cases where there is a need to stimulate the regional and local implementation of national and/or international policies.

f. Financial resources of regional and local governments are commensurate with their tasks and responsibilities and ensure financial sustainability and self-reliance.