06.02.2026

Climate change as well as national and European climate targets require a far-reaching transformation of public infrastructure in Germany and Austria. A substantial share of the necessary investments falls to the regional and local level: energy distribution networks, water and wastewater infrastructure, flood protection, heat supply, public transport, and green recreational spaces are predominantly planned, financed, and implemented locally. At the same time, municipalities face constrained financial and human resources. Against this backdrop, the question is gaining importance as to whether—and to what extent—financial instruments from the field of sustainable finance, in particular green bonds and green promissory note loans, can make a meaningful contribution to municipal finance.

Sustainable finance and municipal relevance

The term sustainable finance encompasses financial market instruments that, in addition to traditional return and risk criteria, also take environmental, social, and governance (ESG) aspects into account. In municipal practice in Germany, the focus to date has been clearly on environmental sustainability objectives, often even more narrowly on climate mitigation and climate adaptation (Brilon and Raffer, 2025). Relevant instruments include earmarked products such as green municipal loans (so-called green loans), green bonds, and green promissory note loans. In addition, there are ESG-linked loans or bonds, where the conditions are tied to the achievement of overarching sustainability targets, without the use of proceeds necessarily having to be project-specific “green.”

The proceeds from green bonds and green promissory notes must be used for environmental purposes. This requires an appropriate framework that governs the use of proceeds, selection processes, management of proceeds, and reporting. Issuers frequently align their framework with the Green Bond Principles of the International Capital Market Association (ICMA); the European Union also provides a framework in the form of the EU Green Bond Standards, which are closely linked to the EU taxonomy. This framework must also be externally reviewed (second-party opinion). For municipalities, this entails additional requirements for documentation, monitoring, and reporting—an aspect that plays a central role in practice. Since green promissory notes are somewhat less complex to issue than bonds, as they are not traded on stock exchanges, they are in principle more attractive for local governments as issuers.

In Germany, green bonds have so far gained particular importance at the federal and state levels. The federal government has been issuing green federal bonds since 2020, thereby sending an important signal for market development. At the state level, North Rhine-Westphalia is regarded as a pioneer, having issued sustainability bonds with environmental and social components on a regular basis since 2015. Baden-Württemberg and Hesse are also active in the market with several green bonds.

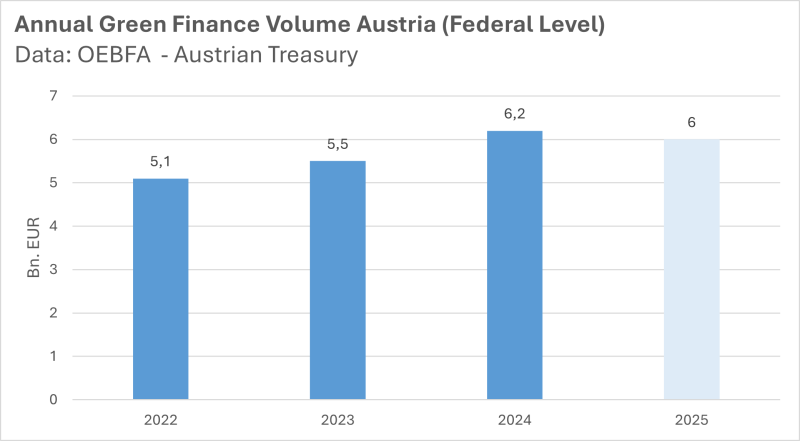

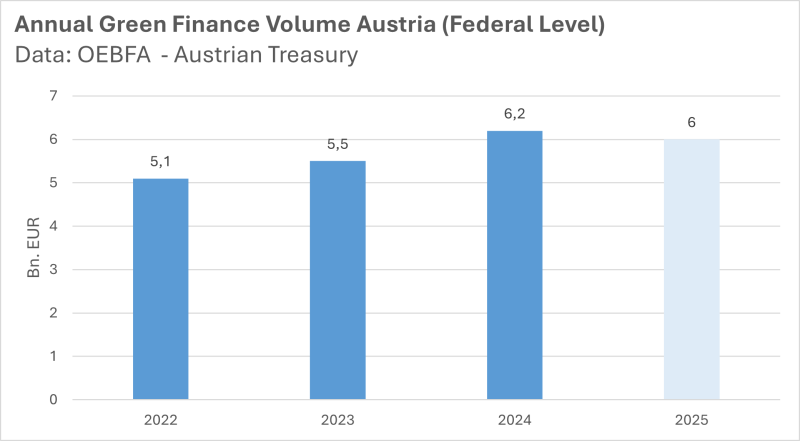

A similar picture emerges in Austria, where around 3.5 percent of federal expenditures in 2023 were classified as green (Stix, 2025). At the federal level, the Austrian green bond is considered a flagship example. The green federal bond has been issued regularly since 2022 by the Austrian Federal Financing Agency within the framework of the Green Finance Agenda (OEBFA, 2023). The proceeds finance climate-relevant federal expenditures and are systematically documented using a green bond framework as well as extensive impact reports. In addition, a range of other financing instruments is used, such as the „Grüner Bundesschatz“ (Green Federal Treasury Note) introduced in April 2024. In a European comparison, Germany—behind France—is among the largest sovereign issuers of green bonds (Brilon and Raffer, 2025).

Municipal practice

While green financing at the federal level in Austria and Germany has thus developed a certain tradition, the situation at the local level is more differentiated. Only a few German municipalities have so far gained experience with green capital market instruments. In 2024, the City of Munich was the first to issue a green bond in the strict sense. More commonly, municipalities resort to green promissory note loans, which are considered less complex and more closely aligned with established lending relationships. The City of Hanover paved the way in 2018, followed by Münster (2022 and 2024), Cologne (2024 and 2026), and Offenbach am Main (2025). The volumes typically exceed EUR 100 million.

In Austria, a systematic approach at the municipal level has so far been lacking. One reason is certainly the volume threshold of around EUR 100 million, from which a green promissory note is generally considered economically viable. Since most Austrian municipalities do not invest at such a scale, the instrument is often not an option in the first place. An important role can therefore be played by municipal and state-owned enterprises. A prominent example is Wiener Stadtwerke, which adopted a comprehensive green finance framework in 2023 (Wiener Stadtwerke, 2023). It covers investments in renewable energies, grid infrastructure, smart metering systems, and zero-emission public transport. The framework is aligned with established standards and regulates the use of proceeds, project evaluation, management of proceeds, and reporting. On this basis, Wiener Stadtwerke placed a green promissory note loan of EUR 260 million in November 2023, which met with strong demand.

When municipal finance decision-makers are asked about the drivers and barriers to using sustainable finance instruments, the picture is rather ambivalent (Raffer, 2024). Key obstacles include comparatively high issuance costs, limited staff capacities, and a lack of specific expertise. From the municipalities’ perspective, the most resource-intensive aspect is the compilation of the necessary information for project classification, use of proceeds, and reporting. Even municipalities with prior experience emphasize the considerable administrative effort involved. By contrast, motives for entering into sustainable finance include reputational effects, learning processes within municipal treasuries, the strategic development of competencies, and the diversification of lenders. Whether measurable financial advantages—such as more favorable interest rates—can also be realized remains an open question to date.

An instrument with potential—but no silver bullet

Green bonds and green promissory note loans are not a panacea for municipal investment finance. Their potential lies less in short-term interest rate advantages than in strategic effects: better structuring of investment programs, increased transparency, institutional learning gains, and stronger connectivity to sustainability-oriented capital markets. At the same time, experiences from Germany and Austria show that these instruments involve significant transaction costs and require specific administrative capabilities. For many municipalities, they are therefore likely to be considered—at least in the medium term—only as a complementary building block within a broader financing mix. To make the instrument more attractive for smaller municipalities, greater consideration could be given in the future to joint issuance under the leadership of state or federal authorities.

This topic was recently discussed by the Cities for Sustainable Public Finance (CSPF) network of European city CFOs, where their experiences with green finance instruments were exchanged. More information can be found on www.cspf.eu.

References

Brilon, Stefanie; Raffer, Christian (2025): Zur Perspektive von Sustainable Finance und Nachhaltigkeitsberichterstattung auf kommunaler Ebene. KfW Research, Fokus Volkswirtschaft Nr. 514.

OEBFA – Österreichische Bundesfinanzagentur (2023): Grüne Bundeswertpapiere – Veröffentlichung des ersten Grünen Investorenberichts. Online: https://www.oebfa.at/presse/presseuebersicht/2023/green-investor-report-2022.html

Raffer, Christian (2024): Die Rolle von Sustainable Finance in deutschen Kommunen. Difu-Impulse 7/2024. Online: https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Studien-und-Materialien/Sustainable-Finance-Kommunen.pdf

Stix, Markus (2025): Von Green Bonds bis zum Grünen Bundesschatz – Grüne Finanzierungen der Republik Österreich als Katalysator der Grünen Transformation. Präsentation vom 14. Mai 2025.

Wiener Stadtwerke (2023): Grüne Schuldscheindarlehen, Allokations- und Wirkungsbericht zum 31.12.2023. Online: https://www.wienerstadtwerke.at/o/document/allokations-und-wirkungsbericht-zum-31-12-2023-1-