Tax revenue is distributed to the federal, regional and local governments through financial equalization. A large part of the taxes are collected centrally by the federal government and some are passed on to regionals and municipalities. In Austria, comparatively few own taxes are collected, whereas complex transfers are becoming increasingly important. Below is a brief overview of the Austrian fiscal equalization system.

How the State Distributes Tax Revenue in Austria

Austria, as a federal state, operates on a multi-level administrative system comprising three levels: the federal government, the regions (Bundesländer), and the municipalities. There are nine regions (Bundesländer) and 2,093 municipalities, reflecting a small-scale structure of local administration. Local self-government (kommunale Selbstverwaltung) is enshrined in the Austrian constitution.

Both the federal government, regional governments, and local governments have specific responsibilities to fulfill. At the federal level, responsibilities include national defense and pension subsidies. Regional governments are primarily responsible for public hospitals and social services. Municipalities are responsible for local services of general interest (kommunale Daseinsvorsorge), including childcare, municipal infrastructure (primary education, roads, water supply and waste [water] disposal), and public leisure and cultural facilities.

In principle, each tier of government must bear the costs of providing these services. To facilitate this, provisions for the distribution of federally collected taxes designated as "joint" are outlined in the Fiscal Equalization Act and other related laws, allocating these revenues across the three levels (i.e., shared revenues).

Many responsibilities, such as education, care, or transportation, are also jointly managed by the federal, regional and local governments, adding complexity to the fiscal equalization system. These tasks also exhibit different dynamics, necessitating regular adjustments. Consider, for example, the demographic-driven increases in healthcare or care expenses and the growing need for expansion in childcare or public transport. Additionally, investments are now being made in climate protection and adaptation to climate change.

Consequently, there are numerous transfers, such as co-financing arrangements. Examples include federal co-financing in the area of public hospitals or regional co-financing in early childhood education. Transfers can also pursue specific objectives, such as expanding childcare services or all-day schools. An important function is also to balance the financial capabilities between the regions or among municipalities. Notably, transfers between states and local governments aim to strengthen financially weaker municipalities.

Elements of fiscal equalization in Austria

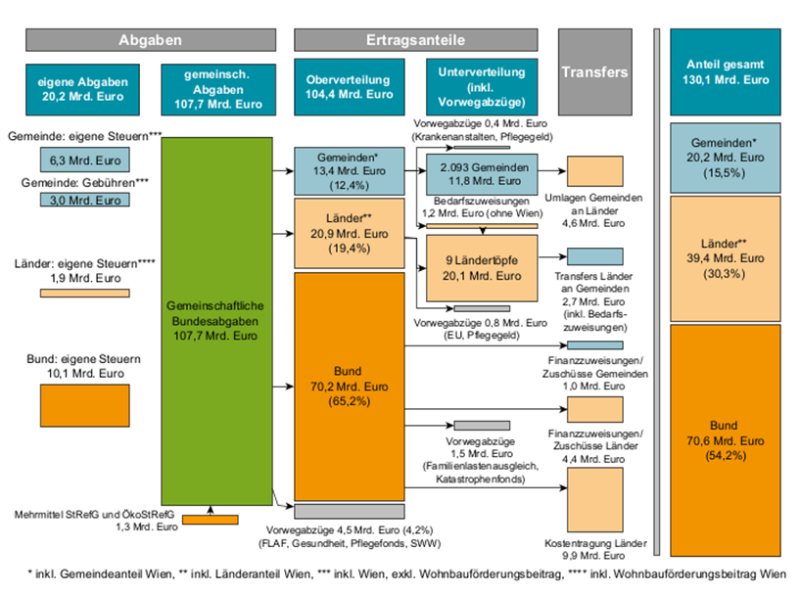

Shared taxes (including VAT, income, and corporation taxes) are the most important ongoing source, as shown in Figure 1. Those are regularly determined in so called financial equalization negotiations between the three tiers of government (federal, regional and local) (Fiscal Equalization Act). This is supplemented by own taxes, which are primarily relevant for the federal government and the municipalities.

The municipalities’ own municipal taxes (these are currently primarily municipal tax [a payroll tax] and property tax) and fees amount to 19% and 10%, respectively. In addition, earmarked charges are levied for water supply and waste (water) disposal. A complicated transfer system among the three tiers of government plays a crucial role. On the one hand, the municipalities have to pay levies to the regions (Bundesländer) (primarily for health and social affairs), while on the other hand the regions (Bundesländer) make transfers to the municipalities as part of the equalisation of resources and to promote investment. Overall, the municipalities make significantly more transfers to the regions (Bundesländer) than they receive in return.

In 2022, these amounted to 19.3 million euros in own taxes (including fees), along with 104.6 million euros in shared taxes.

In addition, there is a complex transfer system between the levels. At the end of the distribution process in 2022, the share for municipalities was 15.4 percent, for the regions 30.3 percent, and for the federal level 54.3 percent.

Shared Taxes

Shared revenues are derived from joint taxes, thus belonging to all three levels of government and constituting by far the largest portion of state revenue. In 2022, € 104.6 billion was collected, of which 34 percent came from sales tax and 36 percent from wage and assessed income tax. These joint taxes are first distributed vertically across the three levels of government, and then horizontally to the regions or individual municipalities. The horizontal distribution key is complex, based partly on population numbers and partly on historically determined fixed keys. For municipalities, the graded population key (i.e., weighted population count) is highly significant.

A crucial aspect is that tax reforms and economic fluctuations affect all tiers of government equally. The federal tax reforms and support packages to manage the COVID pandemic and the energy crisis have significantly slowed the dynamics of revenue growth, for instance, by abolishing bracket creep. If reforms on the revenue side are implemented unilaterally without securing corresponding funding, this leads to a sustainable imbalance between the revenues and expenditures of all three levels of government.

Own Taxes

The second major source of income is the own taxes that individual government levels are allowed to collect for themselves. In total, this amounted to €19.3 billion for the year 2022. For the federal and regional levels, these own taxes are relatively small compared to the shared revenues. At the federal level, these are primarily the employer contributions to the Family Burdens Equalization Fund, which primarily funds family allowances. At the regional level, the housing subsidy contribution became a full regional tax in 2017. The situation is different for municipalities, where own taxes (including fees) constitute 26 percent of revenue.

An important municipal tax is the local business tax, which companies pay to the municipality based on their employees' wages. Also noteworthy is the real estate tax, whose dynamics are relatively low due to a long-overdue property tax reform. Furthermore, fees play a central role at the municipal level. For these, the residents of the municipality are directly charged for municipal services – namely, services such as waste collection, water supply, and sewage disposal.

Transfers Between Government Levels

The original allocation of shared revenues and own taxes is significantly altered through the transfer system.

In 2022, the federal government provided grants to the regions and municipalities amounting to €14.0 billion. This primarily involves transfers for specific purposes, such as public hospital financing or the care fund, and the federal government's assumption of costs for regional teachers. Municipalities also receive transfers from the federal government, such as those within the Structural Fund to strengthen structurally weak regions.

Additionally, there are significant transfer flows between municipalities and regions. The federal states receive levies from their municipalities for the co-financing of certain services, especially regional public hospitals and social services. Conversely, municipalities receive payments for purposes such as budget equalization, as co-financings (e.g., childcare), or investment grants. However, a large portion of these funds comes from the municipal needs-based allocation fund. These are actually municipal funds that are distributed to municipalities through the regions as part of the fiscal equalization process.

The Fiscal Equalization Act of 2024

Since the beginning of 2024, the Fiscal Equalization Act of 2024 has provided a renewed legal basis for a significant portion of the financial flows in the fiscal equalization system. However, there have been no fundamental reforms in the structure of the fiscal equalization. What is observable is a further enhancement of the federal equalizing grants, and thus indirectly a weakening of the tax sharing system. No progress has been made in terms of strengthening own taxes or a more task-oriented distribution of shared revenues. Also, no reforms have been implemented in the area of state-municipality transfer relations.

Reform Needs in Fiscal Equalization

There is indeed a need for reform in the fiscal equalization system. A well-functioning fiscal equalization system is one where revenues, expenditures, and responsibilities are in alignment. This means that each level of government should have sufficient financial resources to fulfill its duties. Key reforms would include task orientation through stronger need-based equalization (both vertical and horizontal), strengthening of tax autonomy (such as through a property tax reform), and a simplification and reduction of transfers.